Table of Content

- Top Ways To Give Stock To Kids

- I'm not a financial advisor, I just trade stocks in the stock market.

- Stock Market Memorabilia

- Our top picks of timely offers from our partners

- These Apple AirPods Pro are 20% off, and make for a great last-minute stocking stuffer

- The traditional way to accept stocks

- #27 Stock Trader Custom Caricature

- Avocado oil lotion bar, Christmas gifts,co workers gifts, stocking stuffer, teacher gifts, gift under10, holiday gifts

All you will need is the recipient's basic personal information and details of their brokerage account. From there, you can input their information into your brokerage account to have the securities transferred to their account. Specific transfer policies vary, so check with your brokerage about what is needed to initiate a stock transfer. If you’re in a position to gift large amounts of stock, money, or other assets this year, you may be able to gift up to your entire lifetime exclusion in 2022 before it decreases. In doing so, you’ll have the additional pleasure of watching your gifts benefit the recipients. If you’re thinking about gifting stock, you’re probably wondering how to actually gift it.

One way is to simply transfer the stock from your brokerage account to the brokerage account of the recipient. Gifting stocks can have advantages for you as the giver and for the person or organization receiving them. There are different ways to gift stock, and it’s important to remember the tax rules before making a gift. In the case of large gifts, you may also want to talk to your financial advisor about how it could affect your overall financial plan. For privately-owned stock, the donor will need to get an appraisal by a broker before donating. First and foremost, the benefits and tax savings of donating stock frequently encourage donors to give what would be considered major gifts, perhaps for the first time.

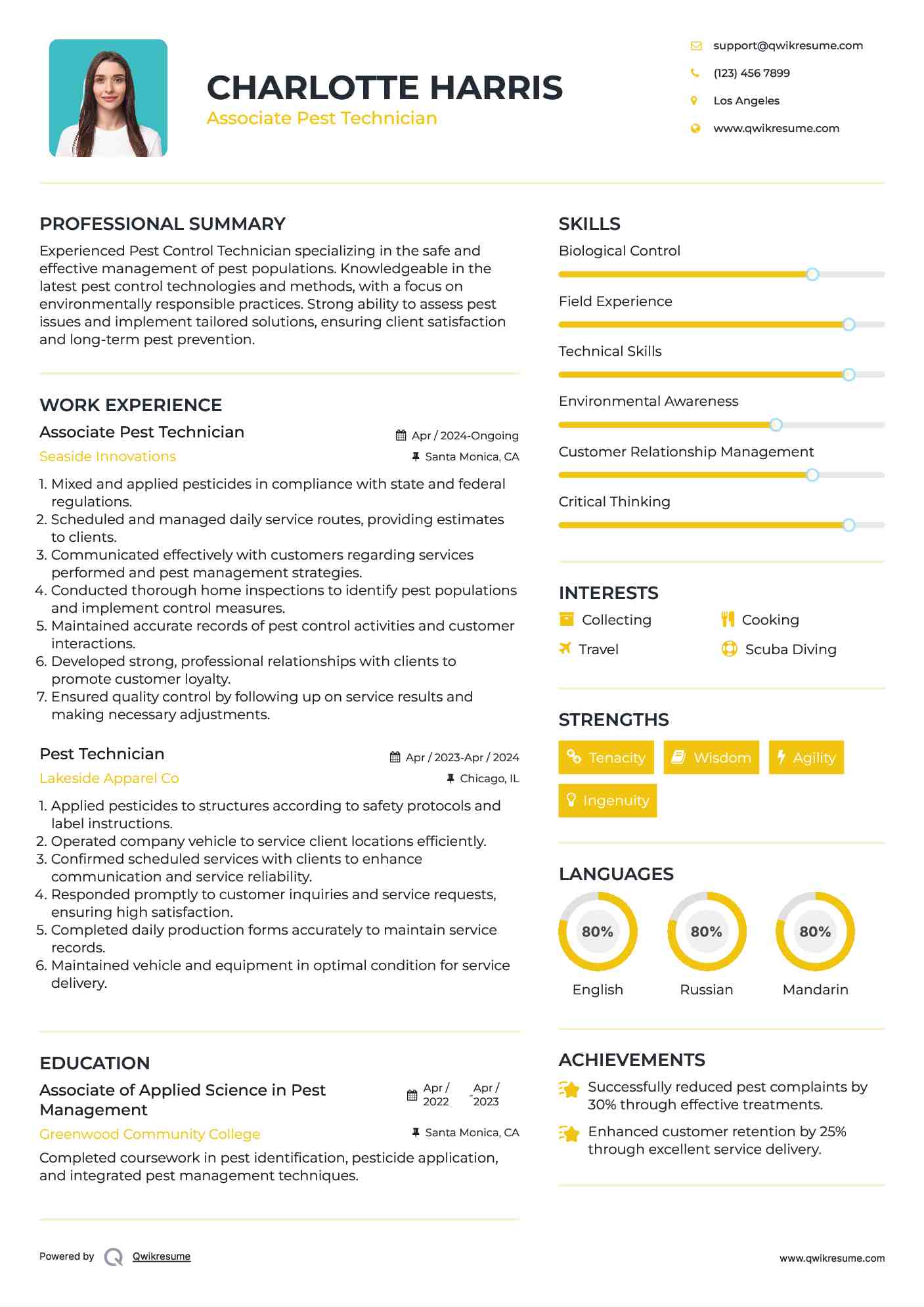

Top Ways To Give Stock To Kids

The giver may be gifting appreciated stock and avoid paying taxes. On the other hand, the stock could continue to grow and increase the value of the gift to the recipient. A donor-advised fund may be something to consider if you have more than just a few shares of stock you want to give to charity or you want to make ongoing gifts. Donor-advised funds are cheaper to set up and maintain than private foundations for people who want to create a legacy of philanthropic giving while enjoying tax advantages. You can also use a transfer on death agreement to gift stocks to adult children or other relatives when you die, without having to set up a trust first. This isn’t exactly a will or a trust; instead, it allows you to transfer assets directly to one or more beneficiaries while avoiding the probate process.

So, if a donor has several children and grandchildren, each can receive the maximum stock gift each year. If you’re donating stocks to charity and you plan to claim that on your taxes, make sure you’re documenting the transaction properly. This usually means some kind of written letter detailing who the stocks were gifted to, the value or amount donated and the date of the donation. Stock fundraising 101 Learn why stock donations are so beneficial for nonprofits and donors, and how your organization can begin accepting these types of gifts. Donors can only receive a charitable tax deduction for the fair market value of their donated shares if they’ve owned them for more than a year.

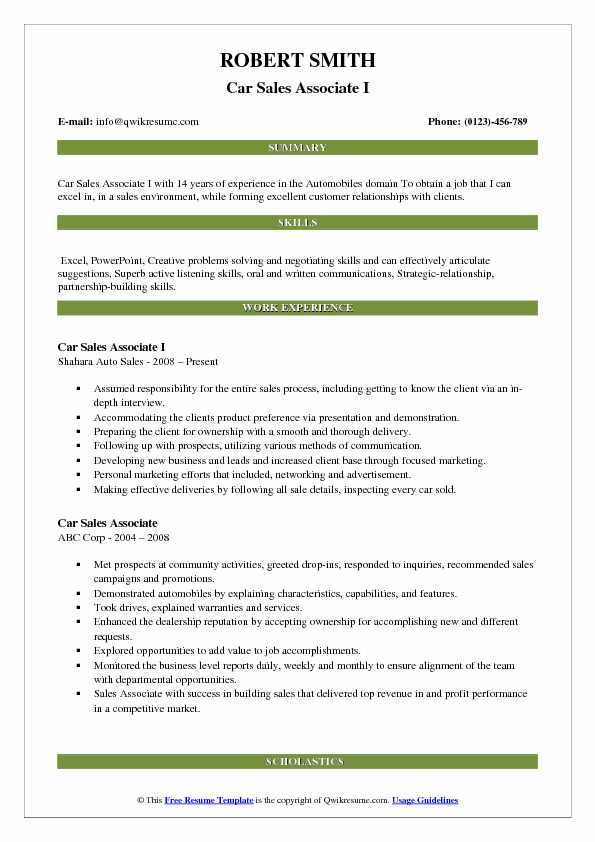

I'm not a financial advisor, I just trade stocks in the stock market.

If you happen to work with computers which is most likely the case as a stock trader, then this mouse pad will be a useful tool for you. You can now conveniently glance on it for details on candlesticks with this pad instead of researching on a topic. There’s just so many things you need to learn or keep track of right now, that you need all the help you can to avoid your brain from getting overworked. These flash cards will provide you with readily accessible candlestick information to always have you on top of your game. Trading stocks has never been an easy job, so this ceramic coffee mug is just what you need to not get too overwhelmed about things. Simply looking at this item as you enjoy your coffee during your breaks will be very helpful in beating stress.

Stocks can be given to a recipient as a gift whereby the recipient benefits from any gains in the stock's price. Giving the gift of a stock can also provide benefits for the giver, particularly if the stock has appreciated in value since the giver can avoid paying taxes on those earnings or gains. Although there are multiple ways of gifting stock, the process depends on how it's currently being held. Gifts of publicly traded securities can be used to support a cause or program you care about while offering you certain benefits. Stock gifts with appreciated value allow you to avoid capital gains taxes and provide you with a tax deduction. If you want to use a broker to gift stocks, the recipient will need an account where they can receive the stocks.

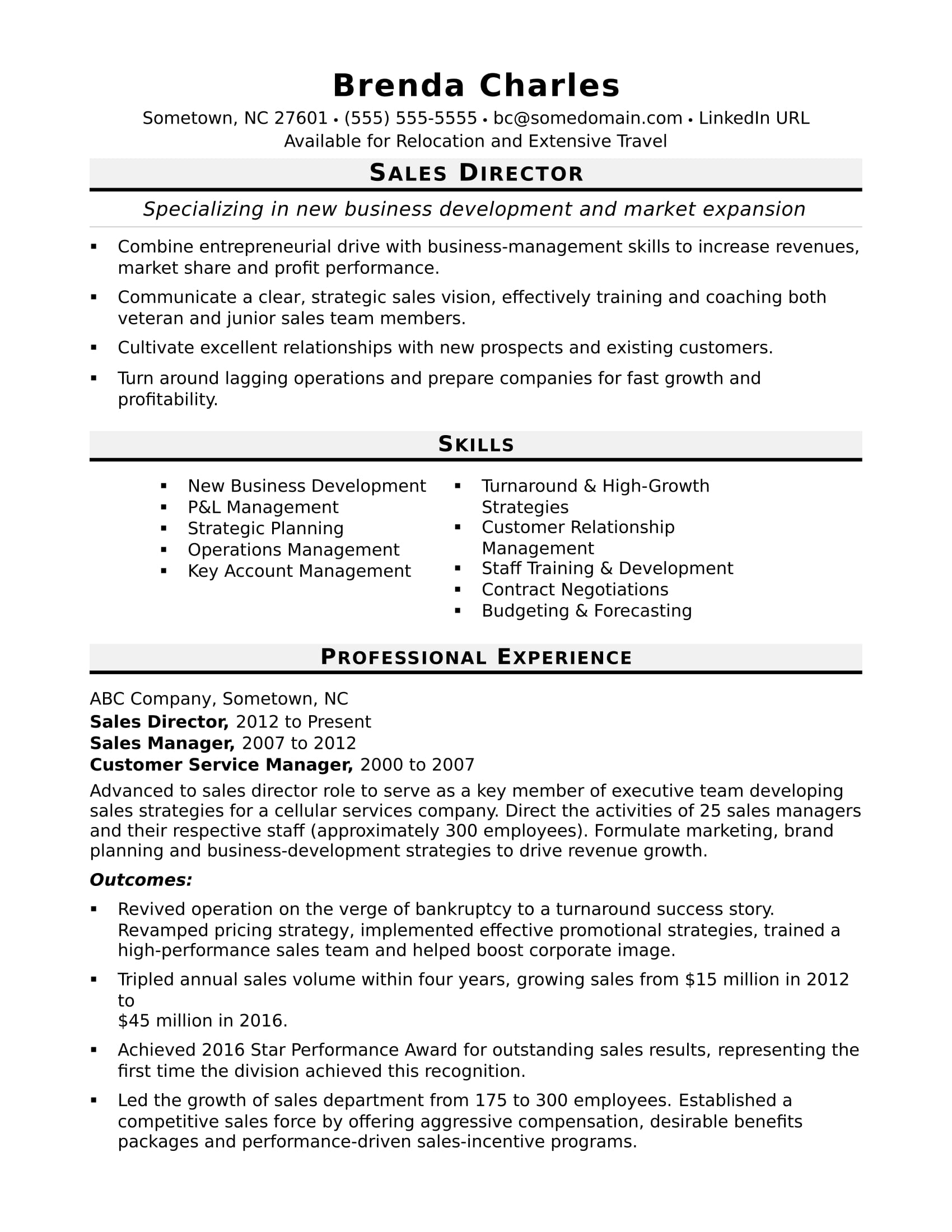

Stock Market Memorabilia

And Series EE bonds are guaranteed to double in value from their issue price within 20 years of their issue date. In exchange for the loan, the savings bond continues to earn interest for up to 30 years. The bond is redeemable for its face value at any time after one year. However, if the bond is redeemed before five years, it loses the last three months of interest. Here are the situations to consider, the potential tax implications and how to keep the holiday spirit involved. We earn a commission from affiliate partners on many offers and links.

Also, the sender will need to be sure there's an account established with the receiving broker before completing the transfer. Mary Hall is a freelance editor for Investopedia's Advisor Insights, in addition to being the editor of several books and doctoral papers. Mary received her bachelor's in English from Kent State University with a business minor and writing concentration. She has been writing about personal finance topics for over six years. So, unless a donor passes away this year, they may not be able to take advantage of the entire lifetime exclusion.

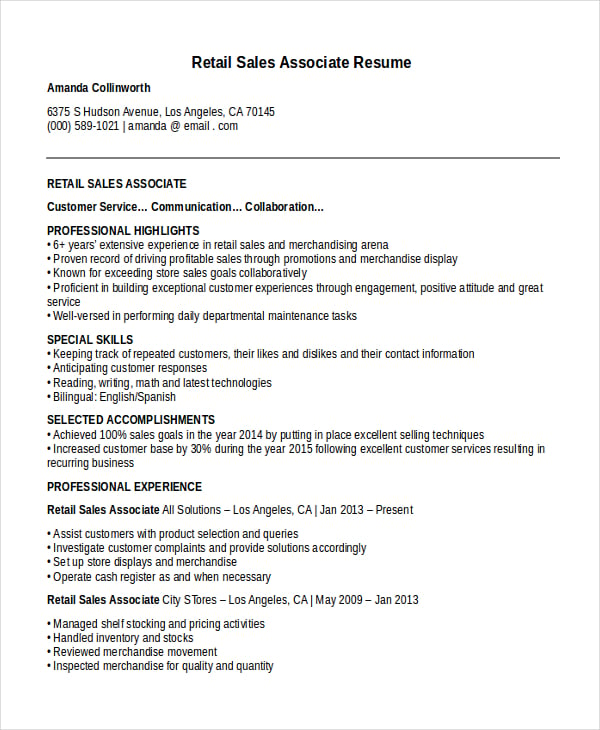

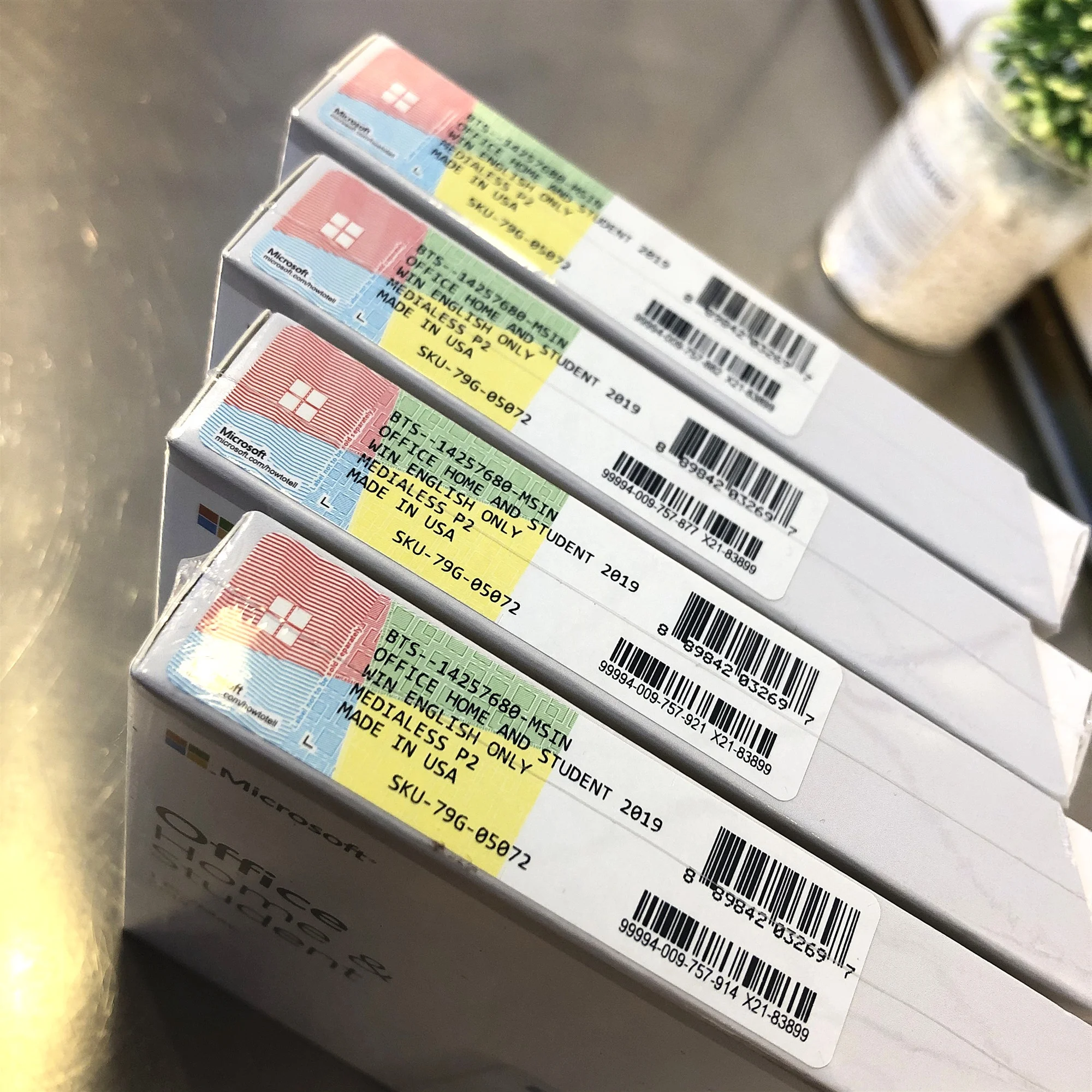

Our top picks of timely offers from our partners

If they were held for less than a year, their deduction is instead limited to the cost-basis, or what they paid for the stock. If a donor is giving private stock, they will need to have the shares appraised by a broker or financial institution to determine the fair market value. In order to receive transfers of stock, you’ll need to open a brokerage account. Accepting gifts of stock should be a top priority for your nonprofit’s development team because they can be particularly impactful. With the average stock donation worth $5,000, these contributions have the potential to be major gifts.

If you plan to gift stocks to kids, consider whether you want to give full or fractional shares. Fractional share investing is a way to buy more expensive stocks in small increments. There are a number of online brokerages that allow you to purchase fractional shares in top companies starting with as little as $1 to $10. Consider talking with your financial advisor about the best way to gift stocks to your children and how that might fit into your broader estate plan. If you don’t have an advisor yet finding one doesn’t have to be difficult. SmartAsset’s financial advisor matching tool can help you connect with professional advisors in your local area.

Here are some ideas for ways you could give stock to your kids or other kids as gifts. A life-long gamer and tech enthusiast, he has a particular affinity for analyzing technology stocks. Muslim holds a bachelor’s of science degree in applied accounting from Oxford Brookes University. Though the crypto market has seen a correction of over 60%, the long-term future of BTC remains positive due to growing institutional investments in the asset class. Furthermore, Bitcoin halving is expected to happen in March 2024, and its effects could be quite promising. Analysts are of the opinion that it could potentially trigger a surge towards $100,000.

Your broker will need this information to set up the custodial account. Once the donor sets up the custodial account, they can transfer shares like you would with other brokerage accounts. The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

As mentioned above, it’s also recommended to collect donor information before encouraging them to directly initiate the transaction. For 2022, your total contributions each year to your Roth IRAs and traditional IRAs can’t be more than $6,000 (or $7,000 if you’re 50 or older). Note that you can't contribute more to a child's Roth IRA than they earn per year in income. Financial gifts may not be the first thing you think of when deciding what to buy someone for the holidays.

Gifting shares of stock can be a fun way of creating interest in the stock market, a company, or a particular industry. Stock shares can be gifted to recipients from an existing investment portfolio through a brokerage firm. Stock shares can also be gifted to children as a single share to teach them about money, investing, and saving.

The way they work is that the money you pay for a savings bond represents a loan to the U.S. government. Whether you have a minor or an adult in mind, Select details how you can gift stocks this holiday season, and what to consider before doing so. Our collection includes whimsical items as well as practical ones, making it easy to find gifts for stock traders or gifts for financial planners that stand out.

If the stock is being held in certificate form, transferring the physical stock will be required. The owner must endorse the stock by signing it in the presence of a guarantor, which can be their bank or broker. Since the Public app allows you to buy small slices of stock as gifts, this is a great avenue for purchasing stock for kids no matter what your budget is.